“The anti-fraud center will be a technological platform, which financial organizations, law enforcement agencies, and cellular operators will be connected to. The platform will include the exchange of data between financial market entities in real time on fraudulent transactions, including suspicious transactions with appropriate markings,” the press service of the National Bank reports.

An anti-fraud system is a set of measures that allow evaluate banking or internet transactions for the degree of likelihood of fraud. For that, certain criteria are applied to each operation, and if it does not meet them, the system checks it more carefully and signals about it.

Built-in filters help recognize unusual behavior and assess the risks of an operation, and then apply measures to allow or prohibit it. In controversial situations, the final resolution of the issue is transferred to bank employees, who are called fraud analysts (fraud with the aim of taking possession of other people's funds or property by deception).

“The task of the Anti-Fraud Center is to ensure the protection of citizens’ funds from fraudulent transactions, a prompt response to fraudulent transactions and their timely blocking. Industrial implementation with full functionality is planned on July 22 of this year, from the moment the relevant Law on digitalization issues comes into force,” the National Bank concluded.

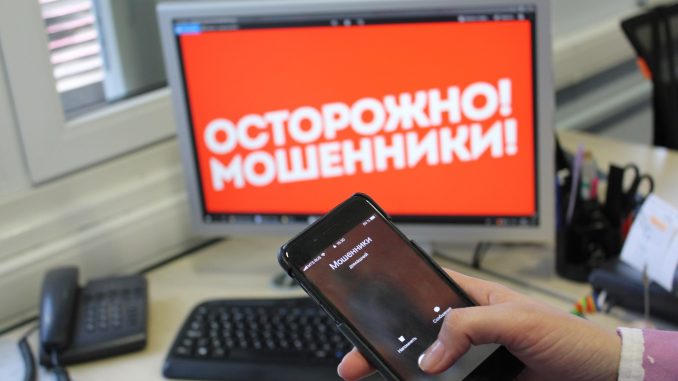

Photos are from open sources.