There are different types of life insurance plans:

Term insurance plans are basic plans that offer a guaranteed payout in the event of the insured’s death during the policy term; they have no investment component. Term insurance plans help secure a family's financial future when one of family members dies. Despite the lack of tax benefits, many people buy such policies because they are considered inexpensive.

Goal plans function like fixed-term plans but they include a funded component. The owners of such policies receive money when the contract with the insurance company ends. A guaranteed benefit in the event of the policyholder’s death is paid to the beneficiaries.

ULIPs are investment life insurance plans. They are more suitable for affluent people with different risk tolerance, as insurers choose instruments in the stock market.

Annuity plans with lifetime coverage are also called retirement plans; they are designed to provide a regular income after retirement. This is done by distributing money accumulated over several decades.

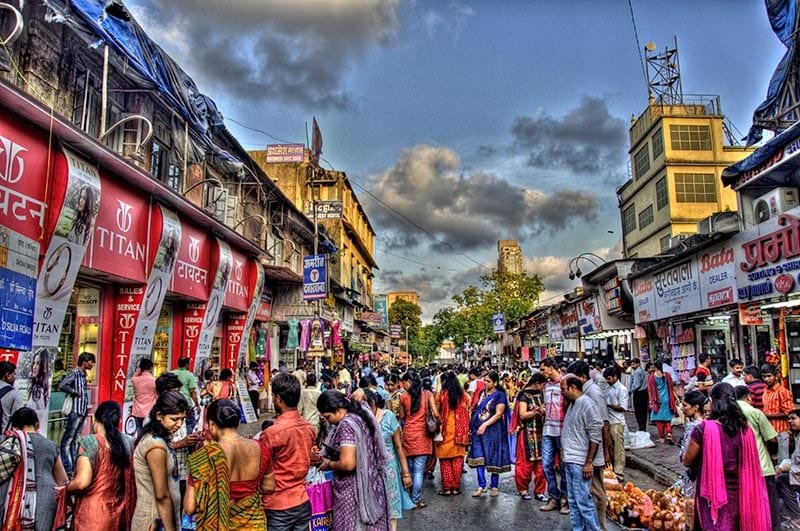

Photos are from open sources.