In the voluntary personal insurance sector, the accident insurance segment has been growing for the second year in a row: both premiums collected and premiums are increasing.

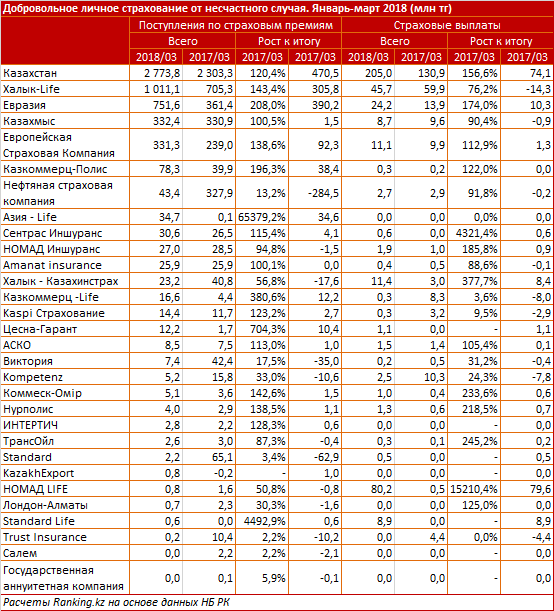

The volume of collected premiums as of January-March, 2018 amounted to 2.8 billion Tenge, which is 20.4% more than for the same period in 2017. Their share of the total volume of premiums in the voluntary personal insurance segment increased from 9% to 9.4%, from 2.2% to 2.6% on all insurance premium incomes in general.

The volume of payments to the Kazakhstani insured against accidents increased by 56.6%, to 205 million Tenge as of January-March, 2018. The share of insurance payments in voluntary personal insurance increased from 1.5% to 2.5%, the share of all insurance payments grew from 0.5% to 1%.

Premiums on voluntary personal insurance in the first quarter of the year were collected by 29 insurance companies. In terms of revenues, Halyk-Life is leading with 1 billion Tenge, by 43.4% more than last year.

Next is "Eurasia" with 751.6 million Tenge, which is 2.1 times more than last year's result. Kazakhmys closes the top three leaders with 332.4 million Tenge, which is only 0.5% more than in the same period in 2017.

On insurance payment volumes as of January-March, 2018, Nomad Life is leading with 80.2 million Tenge, followed by "Halyk Life" with 45.7 million Tenge, "Eurasia" is on the third place with 24.2 million Tenge.

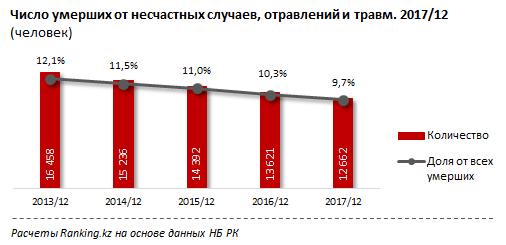

It is also noted that the number of deaths from accidents, poisoning and injuries in Kazakhstan as of January-December, 2017 was 127 thousand people, 7% less than in 2016. The share of accidents among the main causes of death for the year decreased from 10.3% to 9.7%.

Photo per website: aktivfinans.su