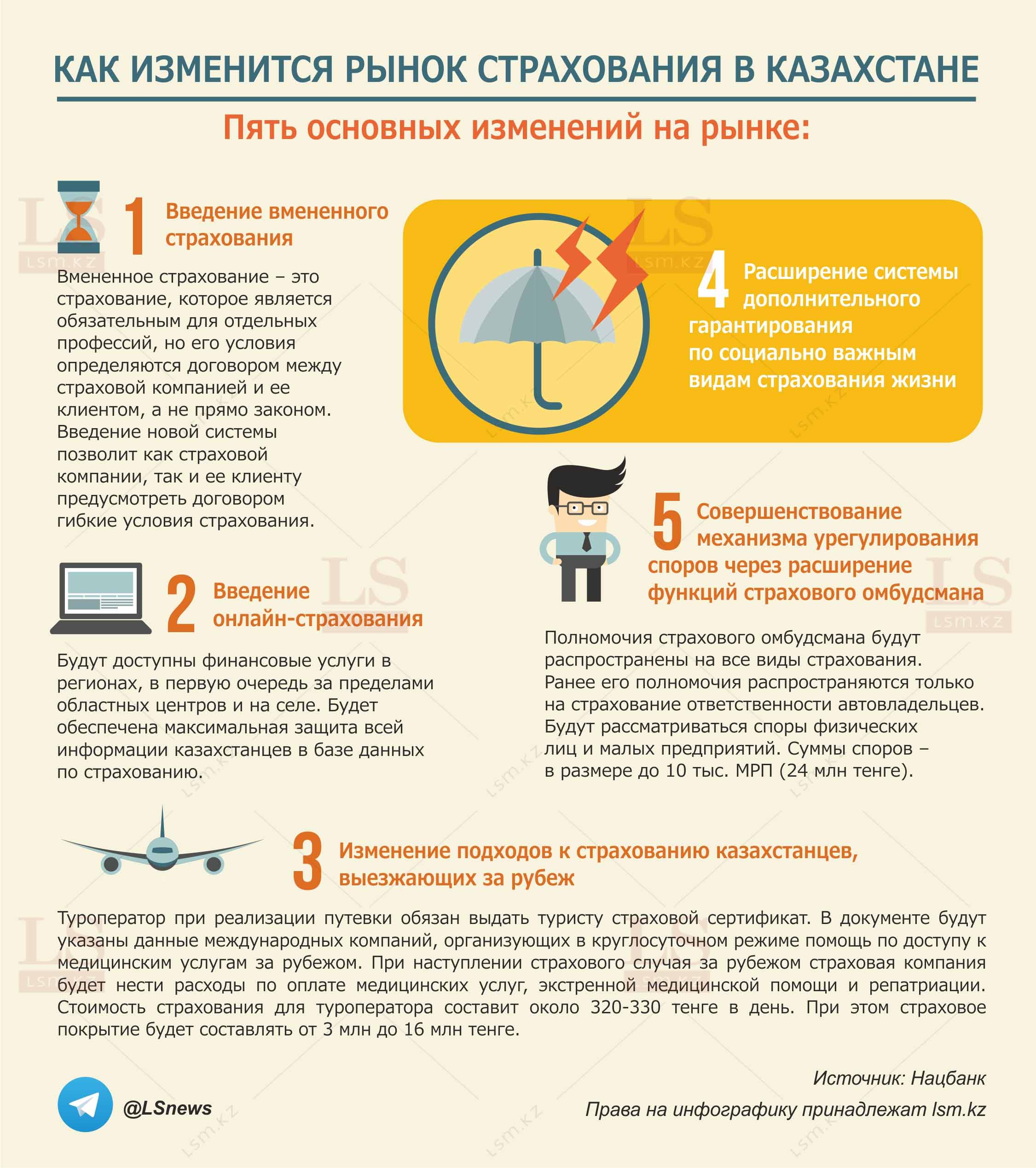

As Daniyar Akishev, the Head of the National Bank stated earlier, the new document suggests five major amendments in the market.

First of all, the approach to insure Kazakhstanis going abroad is to change.

At present, insurance works only if it is proved that the tour operator was mistaken (with insurance of the tour operator’s responsibility). When the amendments are in force, the tour operator will be obliged to issue the insurance certificate along with the voucher. The document will indicate the data of international companies that organize support for 24-hour a day access to medical services abroad.

In case of insurance event abroad, the insurance company will bear expenses for medical services, emergency medical care and repatriation.

The cost of insurance for tour operator will be about 320-330 Tenge per day. Coverage will be from 3 million to 16 million Tenge.

Secondly, introduction of imputed insurance

Unlike the existing types of insurance, voluntary and compulsory, imputed insurance will have a voluntary-compulsory form. It will create terms between the client and the company, which will be regulated by the contract and not by law directly.

The introduction of this new system will allow both the insurance company and its client to provide for flexible insurance terms.

The next direction is introduction of online insurance.

Financial services will be available in regions, primarily outskirts the regional centers and in countryside. The National Bank promises maximum protection of people’s information in the insurance database.

The fourth direction is the expansion of the insurance ombudsman’s functions.

The powers of the insurance ombudsman will include all types of insurance. Previously, its powers were only applied to car owners. The ombudsman will be able to consider disputes between individuals and small businesses for amounts of up to 10 thousand MCI (24 million Tenge).

The fifth change is the expansion of additional guarantee system for socially important types of life insurance.

Source: https://www.lsm.kz/kak-izmenitsya-strahovanie-v-kazahstane-infografika

Photos per website: osdp.info