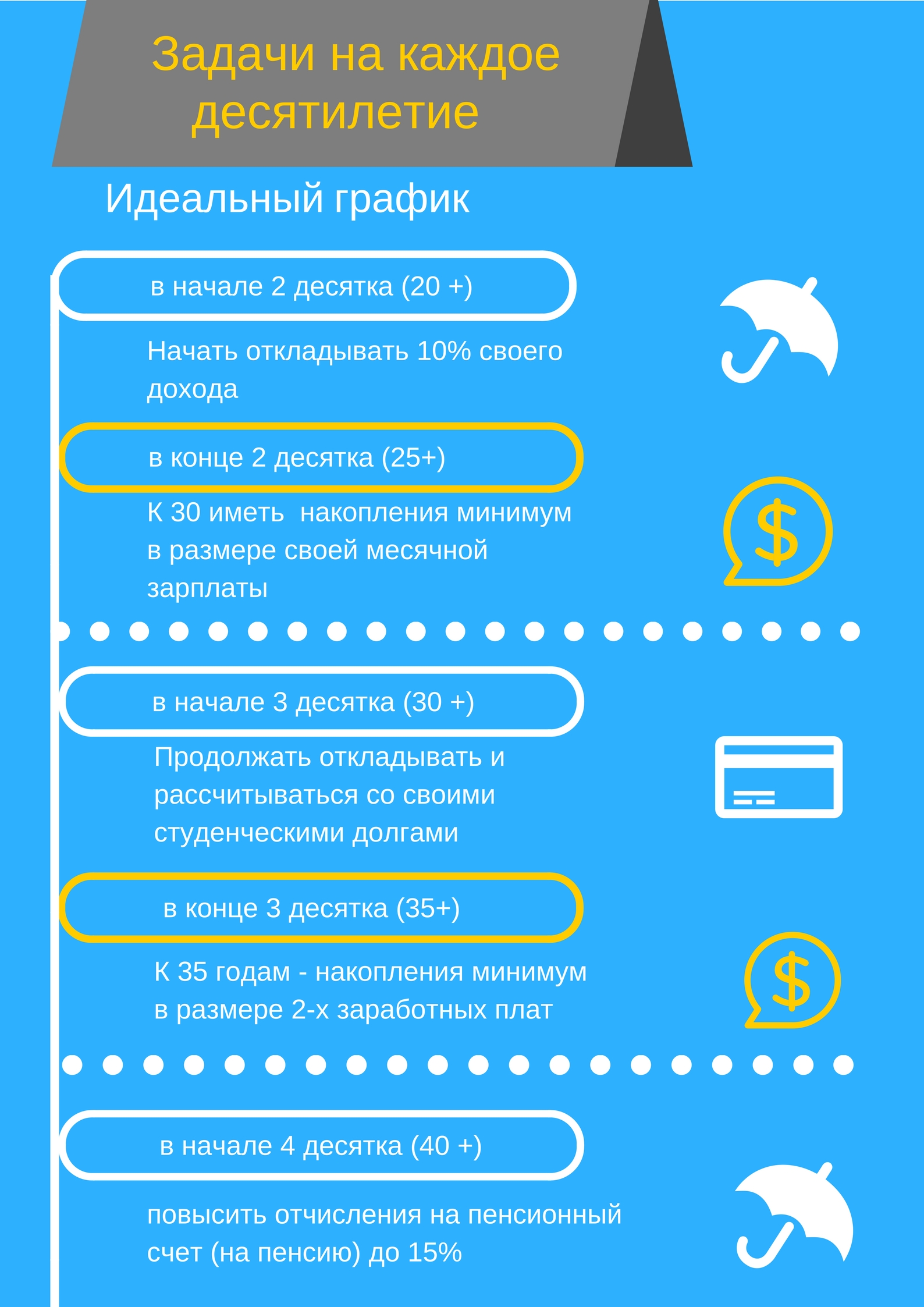

The portal www.marketwatch.com has analyzed the reviews of various experts and research conclusions on financial literacy. So it generated a map of the best recommendations in one info-graphic.

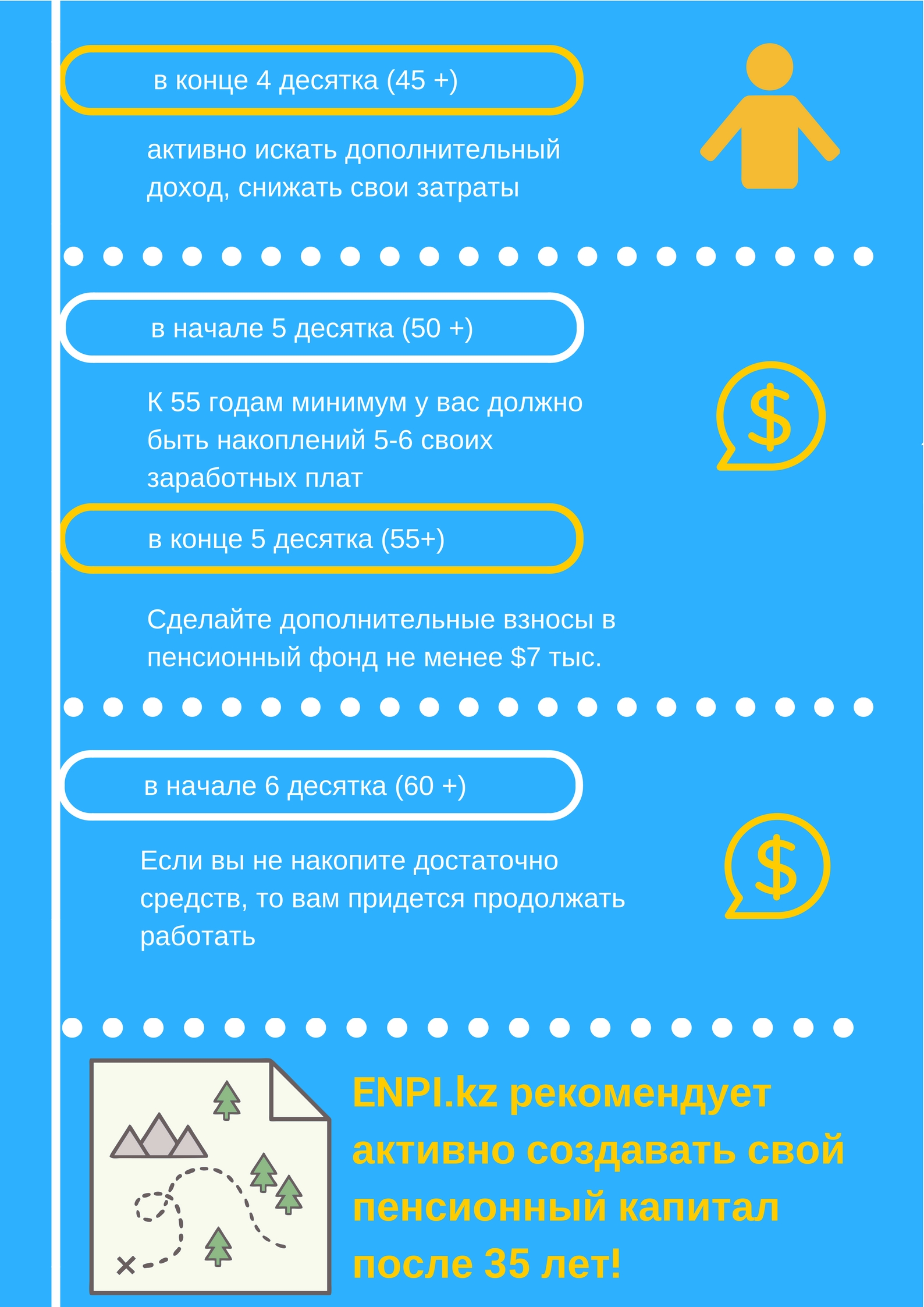

ENPI.kz offers you to learn the ideal time deadlines and precise actions that need to be made for building up a retirement plan.

According to researchers from the US Census Bureau, only a third of company employees make monthly contributions to their pension plans. According to the Federal Reserve System "Consumer Finance Survey" conducted in 2017, a typical American working-age couple has only $5,000 and only a few baby boomers are financially ready to retire.

Nevertheless, employees of American companies are beginning to take measures to form pension savings. A study by Fidelity Investments and Bank of America suggests that balances for pension plans and individual retirement accounts in the US have reached a record level, and that more people are paying in their retirement accounts more than they did a decade ago.

Millenials, in particular, seem to be very interested in building their confident future. Their parents and grandparents who suffer from the financial crisis since the end of the 2000s are a good motivation.

According to the American experts, young people in their 20s should start saving for their retirement plan even if it is a monthly contribution of 5 or 10 dollars. It is not the size of the sum that is important, but the habit of doing this and the strength of a complex bank interest.

30-year-olds should not let mortgages, marriages or children distract from their monthly installments on pension accounts.

Forty years is a critical time to form your retirement place, as many people reach the peak of their careers and monthly income at this period.

For those who could not save as much as they wanted, the period after 50 years of age is the last chance to catch up, because many financial responsibilities related to raising children or servicing mortgage loans are being reduced.

When the 60th anniversary comes, the main question is whether the accumulated funds are enough to retire or you need to continue working a little longer.

Source: https://enpi.kz/mezhdunarodniy-opyt/dorozhnaya-karta-pensionnyih-nakopleniy

Photo per website: densegodnya.ru