According to some reports, India became the progenitor of Unit-linked products, where the Unit Linked Insurance Plan (ULIP) by Unit Trust of India was launched in 1971. There is an alternative point of view, according to which the first Unit-linked products appeared in the UK a few years earlier.

Whatever the case, now Unit-linked products are widely developed in the world, especially in European countries, where they are the main driver of the life insurance market. The average share of Unit-linked products ranges from 20 to 40% of total life insurance in European countries. Such policies combine features of an insurance and investment product. They are equity insurance giving ample opportunities for investment and savings and, importantly, providing tax preferences (profitability on such policies is not taxed). Unit-linked also provides the transfer assets by inheritance. This product is well suited for long-term investment of spare funds, from 10 years and more.

In this segment, there are policies with guaranteed returns (about 2-3% in USD), but in most cases, returns are not predetermined and depend on the situation on the stock market, as well as chosen strategy. The client either selects one of the tens or hundreds of investment funds in which the insurance company subsequently invests his money, or orders to buy and sell certain assets, similar to how he does it with a broker. The tool palette is stocks, bonds, foreign exchange market and mutual funds. When the price of assets falls, drawdowns are not ruled out.

Thus, the investment strategy in case with Unit-linked can be very flexible and completely depend on client’s wishes, says Vladimir Chernikov. According to him, ILI products in Russia do not yet provide such an opportunity: the client is offered a choice of one or another “boxed” solution that does not imply the possibility of client intervention in investment management.

Unit-Linked the Russian way: contribution life insurance

In short, writes Mr. Chernikov, the future lies in the deliberate consumption of multifunctional, investment and insurance instruments. He notes that the mega-regulator has recently talked about the need to create a legislative base in Russia for the emergence of shared life insurance products, which are very similar to Western Unit-linked products. However, before this plan is put into practice, obviously, time and adjustment of some legislative norms, including tax and insurance legislation, are needed. The emergence of Unit-linked (equity insurance) products on the Russian market would be very timely, this product would take its rightful place in the line of investment products, the expert emphasizes.

To his mind, in order to reach a whole new level of life insurance products, it makes sense to focus on the historical experience of the foreign market. It is important to bear in mind that the share of life insurance in the total insurance market in developed countries today is 50%, and in Russia - only 30%. The potential for development is enormous, writes Vladimir Chernikov.

Endowment has a palm of victory

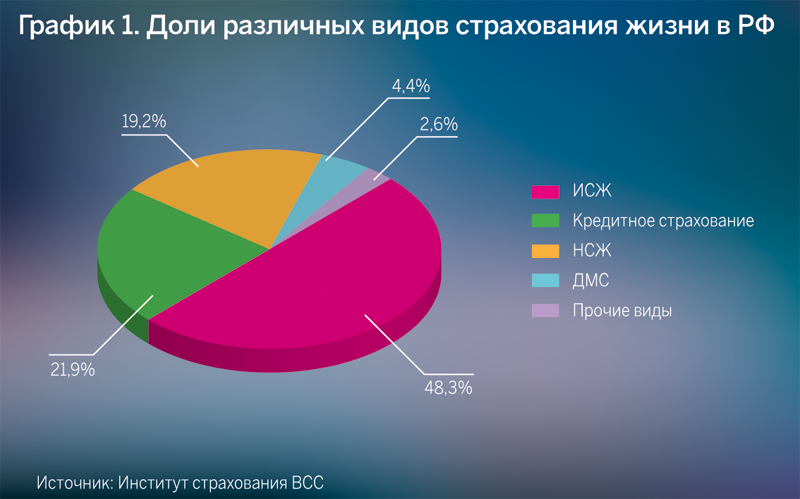

He also noted a new trend in the insurance market of the Russian Federation: endowment has become the first in terms of growth rates. According to him, the volume of ILI showed a decrease by a quarter and the collected premiums for endowment increased by 49.6%. If at the end of 2018, endowment insurance fees amounted to 14%, and investment life insurance premiums - about 61% (in the total amount of life insurance premiums), then in the 1st Q 2019, investment life insurance have made only 48% of all premiums collected, and endowment insurance fees have risen to 19.2% of the market.

Endowment, in fact, resembles a “mortgage the other way round”. Having signed a mortgage agreement with the bank, the client immediately receives a large amount, acquires real estate and over the course of several years returns this amount to the bank with interest. By concluding the endowment agreement with the insurance company, the client contributes a certain amount of money on annually basis for a long period (up to thirty years). At the end of the contract term, the amount of contributions plus a distinct additional investment income are formed on the account. Besides, the endowment policyholder is protected from various risks associated with life and health. The range of risks in universal life insurance can be very wide: it is death for any reason (including accident), disability, critical illness, injury, grievous bodily harm, the option of exemption from payment of fees and, of course, the risk of survival (when the client survives until the end of the policy); the whole amount with investment income is returned to him.

Insurance coverage of universal life insurance is much broader than in investment life insurance, the expert notes. Endowment is more aimed at providing a “comfortable future” for the client; it is a reliable saving tool. The policyholder makes regular contributions and by the end of the contract period receives a tangible amount, which he can use, for example, to pay for education, home improvement or another way to improve the quality of life (for instance, regular payments as a pension). Endowment is a potentially more massive product than ILI; it has a social orientation being designed to educate citizens by adopting a habit of saving spare funds for large acquisitions without loans.

An important feature of the universal life insurance, as well as investment life insurance, is that for the duration period of the contract the fund owner is not the client but the insurance company. This circumstance protects the money in the insurance policy from the division of property; it cannot be confiscated or arrested. All life insurance policies in Russia are also subject to a tax deduction of up to 120,000 rubles annually.

Along with universal life insurance, combined insurance products with a certain service component are gradually gaining popularity. They can contain, for example, telemedicine services, medical check-ups, etc. This is usually not the main “dish” for a client but a pleasant complimentary that increases loyalty to the insurance company. Such products, quite possibly, have a great future.

Source: https://bosfera.ru/bo/produkty-unit-linked-novyy-orientir-rynka-strahovaniya-zhizni

Photos are from open sources.