The banks are taking their time to raise the rate on dollar deposits to 2% following the regulator’s relevant decision. Only two players did it promptly. What other options of placing foreign currency liquidity do Kazakhstani people have?

New financial tradition of Kazakhstan is the summer cat and mouse game between Tenge and US Dollar. Ironically, for several years in a row, a month before the vacation period, Tenge has steadily depreciated. This year was an exception. A favorable for our country, price for oil and strong Ruble became the key to the national currency success, according to the National Bank. However, some Kazakhstanis tenaciously keep their savings in USD; nothing can make the adherents of the “American” change their historical preferences. It would be fair to note that the number of such people is decreasing. According to the National Bank, as of May 1, the volume of deposits in foreign currency has decreased to 7.027 trillion tenge. The level of dollarization in the banking system was 41%, having fallen from the year beginning by 7.4%.

Not much but guaranteed

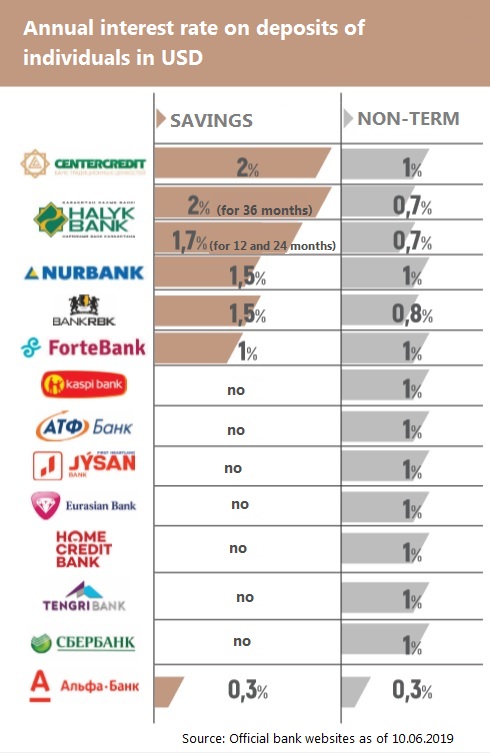

It is commonly believed that Kazakhstan Deposit Insurance Fund dissuades from USD deposits. Once a quarter KDIF publishes recommendations to banks on maximum rates of return. The former Head of the National Bank, Daniyar Akishev, adhered to a strict conservative policy, and the return rate of dollar deposits was falling. With Yerbolat Dossayev, the situation has changed: the allowed rate on savings deposits in USD has increased to 2%. However, the banks are holding off on KDIF recommendations. Only two of 13 organizations reviewed by Kursiv, have raised their rate to the maximum; and in one of them, in order to earn the required 2% per annum, the money will have to be frozen for three years.

“The deposits with the possibility of replenishment and withdrawal at any time without loss of remuneration are still the most popular. Unfortunately, savings deposits have restrictions in this part. Our goal is customer satisfaction,” stated the Sberbank subsidiary.

“Our main priority is services and products in tenge. Kaspi dollar deposit is a convenient tool for storing currency, but does not have all the advantages of our deposit in tenge,” they commented in Kaspi.

The profitability on dollar deposits in STB ranges from 0.3 to 2%. But even the 2% rate is less attractive compared to many Kazakhstani Eurobonds denominated in USD, says Nurlan Ashinov, director of analytics at Kazkommerts Securities. In his opinion, the banks are not offering the maximum rate because of lack of demand for foreign currency. “Banks now hardly lend in foreign currency, they need it only for repaying foreign loans, but there are no large repayments yet, and there’s not much demand,” the expert explains.

This opinion was confirmed by the Deputy Chairman of the Board of Halyk Bank Murat Koshenov at the annual conference of Fitch Ratings: “Placing dollars is much more difficult. With a large dollarization of deposits, you have few opportunities to lend in dollars. For example, in our bank, the share of foreign currency loans fluctuates in the range of 25–30%. There is also the National Bank coefficient, considering it, most of the funds raised on the domestic market should be placed also on the domestic market, and there are not a lot of dollar borrowers.”

Financial Institutions’ Association of Kazakhstan is more positive about the market movements reminding that earlier the dollar deposit interest rates have mainly varied within 0.5–1% per annum. “KDIF innovations have been published this month. In this regard, it is not entirely correct to judge the banks’ reaction, since each bank has its own structure of foreign exchange assets and liabilities. Some participants probably need time,” said Ramazan Dossov, an expert at the FIAK analytical center.

The chief analyst at ALPHALUX Consulting, Sergey Polygalov, draws attention to another important factor for the investor, the foreign currency revaluation. “Due to the relative stability of the exchange rate, the return on deposits in USD (in equivalent of tenge - Kursiv) for the last six months amounted to only 4% and on savings deposits in tenge - 6.5%. As for profitability of dollar deposits opened three months ago, in the revaluation it was only 0.5% against 3.3% on tenge deposits,” the expert calculated. In his opinion, the rate of return on foreign currency deposits, taking into account the revaluation, can be predicted only in the long term; short-term forecasts are difficult.

“It is clear that the national currency rate is subject to devaluation changes, but it is rather difficult to predict how the weakening will be carried out. In the case of a smooth depreciation with periodic strengthening in the short term, there may be losses on exchange rate differences during conversion,” stated Mr. Polygalov.

Nonbank instruments

While the banks are in no hurry to increase the rate of return on dollar deposits, the brokerage companies offer their alternative. Thus, Freedom Finance IC is implementing the dollar bond program “Rentier”. The frequency of payments is once a month, weighted average yield is 6% per annum. It is obvious that with $50 enough to open a bank deposit, the client will not get into this program; the “entry point” here is $14,000. For those who do not have such savings, the broker offers tenge bonds, the value of which is linked to the dollar rate. The profitability on them is declared at the rate of 7% per annum.

The entry point of life insurance companies is more modest, but also less profitable. Thus, Nomad-Life is ready to draw up a contract for $1 thousand promising a profit of 3.41% per annum.

According to Sergey Polygalov, there are a large number of alternative financial instruments on the market today, which, when compared with banks, are, firstly, no less reliable, and secondly, they give a higher profitability in foreign currency. “Eurobonds of quasi-state companies can be singled out among such instruments, the yield of which varies from 3 to 8% depending on the issuer and the bond term. Besides, insurance on these securities makes up 100% of the investment amount,” the expert concluded.

Source: kursiv.kz